carried interest tax rate 2021

The excess of the 238 net long-term capital loss over the net short-term capital gain for that year is a 238 long-term capital loss carryover to the next tax year. Even if part of the amount on line 3 is carried forward to 2022.

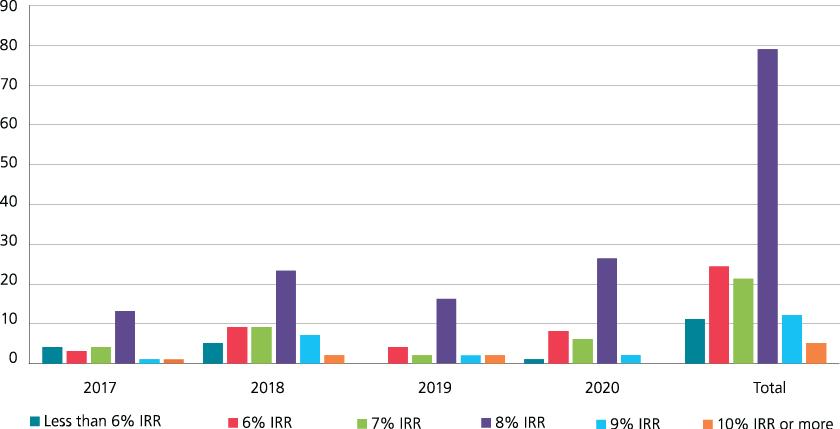

Carried Interest Cms Funds Market Study 2021

The excess of the 37 rate net short-term capital loss over the net long-term capital gain for that year is a 37 rate short-term capital loss carryover to the next tax year.

. If the certificate credit rates are different in the year you. Even if your new loan has a lower interest rate. 2021 Mortgage Interest Credit Department of the Treasury.

Line 8Credit Limit Worksheet.

Pin On Creative Specialist Services

Banks Will Be Closed On These Dates This Week In These States Get Full Bank Holiday List In October Holiday List Growing Wealth October

Carried Interest In Private Equity Calculations Top Examples Accounting

Banking Financial Awareness 20th December 2019 Awareness Financial Banking

Pe Distribution Waterfalls And Their Impact On Client Returns Icapital

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Cms Funds Market Study 2021

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest Cms Funds Market Study 2021

Subordinated Debt Meaning Example Risk And More In 2021 Economics Lessons Accounting And Finance Financial Management

Bank Holidays June 2021 Check If There Is Bank Holiday In June In Your City Holiday Read Holidays In June Tech Job

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services